Maxar Rebrand: Vantor and Lanteris Replace Maxar Intelligence and Space Systems

Update October 2025: Maxar Technologies has officially rebranded. Maxar Intelligence is now called Vantor and Maxar Space Systems is now Lanteris Space Systems.

After eight years as one of the most recognisable names in commercial Earth observation, Maxar Technologies has officially ceased to exist. The company has split into two distinct entities: Vantor (formerly Maxar Intelligence, owner of WorldView satellites) and Lanteris Space Systems (formerly Maxar Space Systems). This restructuring represents the largest shake-up in the commercial satellite imagery sector since DigitalGlobe’s acquisition in 2017.

The split, orchestrated by private equity firm Advent International following their $6.4 billion acquisition of Maxar in 2023, marks a strategic pivot from vertical integration to specialisation. For organisations relying on satellite imagery for critical operations, this transformation raises important questions about service continuity, pricing stability, and the future direction of Earth observation technology.

The Strategic Split: Focus Over Integration

Maxar’s journey from formation to dissolution tells a story of changing market dynamics in the space industry. Created in 2017 through the merger of DigitalGlobe and MDA, Maxar attempted to build a vertically integrated space company combining satellite imagery with spacecraft manufacturing capabilities.

The decision to split reflects a fundamental shift in how the industry views value creation. Rather than maintaining a single entity spanning from satellite construction to data delivery, Advent International recognised that each business unit could achieve greater focus and efficiency operating independently.

Vantor inherits the crown jewels of the former DigitalGlobe empire: the WorldView satellite constellation, decades of archived imagery, and established relationships with government and commercial customers. The company maintains operational control over WorldView-1, WorldView-2, WorldView-3, and GeoEye-1 satellites, collectively providing sub-metre resolution imagery coverage globally.

Lanteris Space Systems takes ownership of the spacecraft manufacturing heritage from SSL and MDA, focusing on power systems, propulsion technology, and satellite bus construction for defense and commercial applications. Their portfolio spans from geostationary communications satellites to deep space exploration vehicles.

What is Vantor? Understanding Maxar Intelligence’s New Identity

Under CEO Dan Smoot’s leadership, Vantor positions itself as more than a satellite imagery provider. The company’s new identity emphasises “end-to-end solutions” that combine multiple data sources into actionable intelligence products.

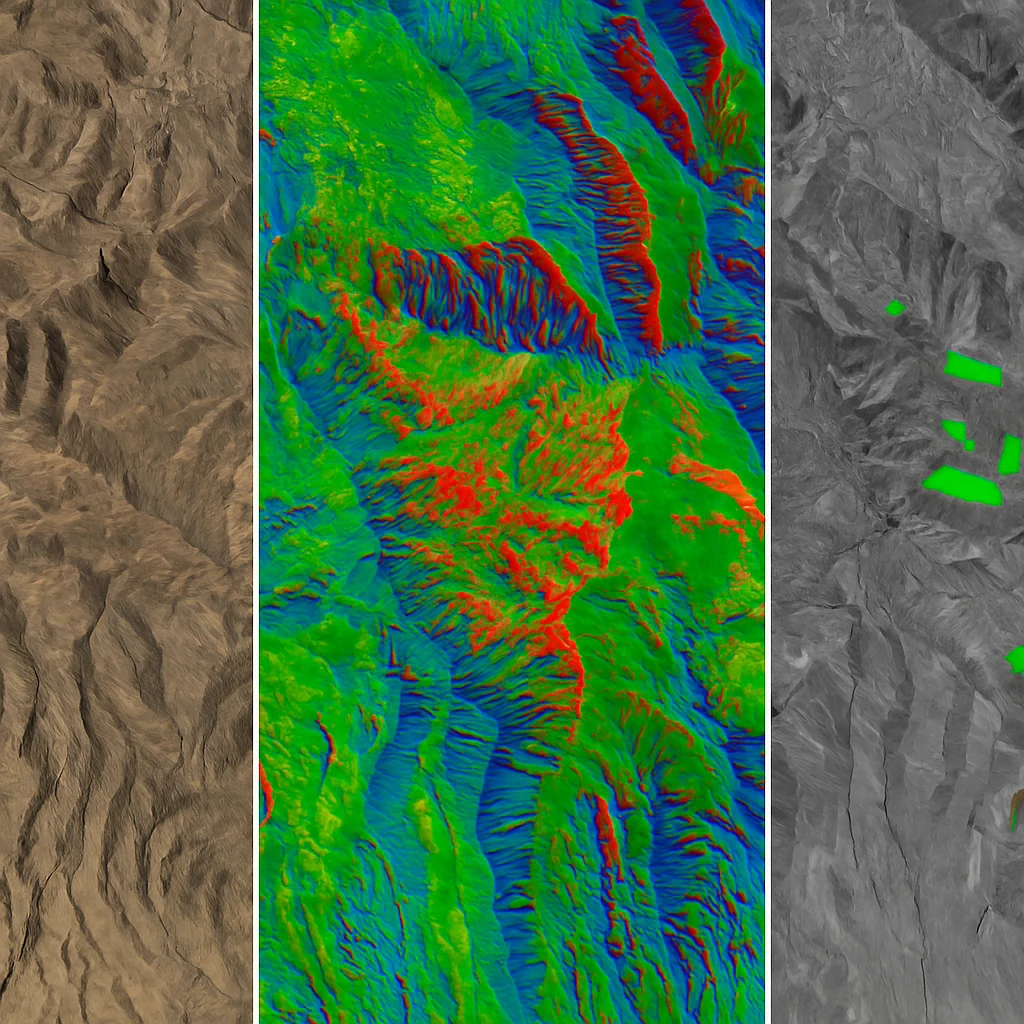

The centrepiece of Vantor’s strategy is TensorGlobe, an AI-powered platform designed to create a comprehensive digital twin of Earth. This system integrates satellite imagery with ground sensor data, aircraft reconnaissance, and other intelligence sources to deliver what Smoot calls “a unified intelligence picture.”

This shift from selling raw imagery to providing processed intelligence reflects broader industry trends. Machine learning algorithms now automatically detect changes, classify objects, and predict patterns across vast archives of satellite data. For Vantor’s customers, this means receiving answers rather than images—a fundamental change in the value proposition.

The emphasis on artificial intelligence isn’t merely marketing rhetoric. Vantor has invested heavily in computer vision capabilities, automated feature extraction, and predictive analytics. Their systems can now identify specific vehicle types, assess crop health variations, and detect infrastructure changes with minimal human intervention.

Market Implications for Imagery Users

For organisations currently using Maxar imagery or considering satellite data for their operations, the rebrand introduces both opportunities and uncertainties.

Service Continuity Considerations

While Vantor assures customers of seamless transition, any major corporate restructuring creates potential disruption points. Existing contracts remain valid, but renewal terms, pricing structures, and service level agreements may evolve as Vantor establishes its independent market position.

The private equity ownership model typically emphasises efficiency and profitability, potentially affecting how Vantor prioritises different market segments. Government contracts, which historically provided stable revenue for Maxar, will likely remain central to Vantor’s strategy. Commercial customers, particularly those in mining, agriculture, and environmental monitoring sectors, should prepare for potential changes in service offerings and pricing models.

Competitive Dynamics Shift

The fragmentation of Maxar creates opportunities for alternative providers. Companies like Planet Labs, with their large constellation of small satellites, and emerging players like BlackSky offer different approaches to Earth observation.

For Australian organisations, this market evolution highlights the value of platform-agnostic solutions. Rather than committing to a single satellite provider, many businesses now prefer access to multiple imagery sources through unified platforms. This approach ensures continuity regardless of individual provider changes while enabling selection of the most appropriate data for each specific application.

Technology Integration Accelerates

Vantor’s focus on AI-driven intelligence products signals an industry-wide shift toward processed data delivery. Raw satellite imagery, while still essential for certain applications, increasingly serves as input for sophisticated analysis pipelines rather than the final product.

This evolution benefits end-users by reducing the technical expertise required for satellite data utilisation. However, it also raises questions about data sovereignty, processing transparency, and the ability to perform independent analysis when needed.

The Australian Perspective: Stability Through Diversity

For Australian businesses relying on satellite imagery for operations, the Maxar split underscores the importance of vendor diversity and platform flexibility. The mining sector, which depends on regular monitoring of vast operational areas, cannot afford disruption in imagery supply. Similarly, agricultural enterprises using satellite data for precision farming require consistent, reliable access throughout growing seasons.

This market reality drives demand for integrated platforms that aggregate multiple satellite sources. Rather than navigating relationships with individual providers like Vantor, many Australian organisations prefer working through local partners who manage the complexity of multi-source data acquisition and processing.

The ability to access WorldView imagery alongside data from other providers—including Wyvern’s hyperspectral sensors, 21AT’s Beijing-3 constellation, and free Sentinel-2 data—provides operational flexibility and cost optimisation opportunities.

Technical Capabilities and Future Direction

Vantor’s technical roadmap emphasises three key areas that will shape the future of commercial Earth observation:

Edge Computing and Real-Time Analysis

Moving processing closer to data acquisition points reduces latency and enables near real-time intelligence delivery. Vantor’s investment in edge computing infrastructure allows preliminary analysis aboard satellites or at ground stations before full resolution data reaches central processing facilities.

Multi-Modal Sensor Fusion

Beyond traditional optical imagery, Vantor integrates synthetic aperture radar (SAR), thermal sensors, and atmospheric monitoring data. This multi-modal approach enables continuous monitoring regardless of weather conditions or time of day—critical for applications like disaster response and emergency management.

Automated Change Detection

Machine learning models trained on Vantor’s vast imagery archive can automatically identify and classify changes across time series data. This capability transforms reactive monitoring into proactive intelligence, alerting users to significant changes before they become critical issues.

Navigating the New Landscape

The transformation of Maxar into Vantor and Lanteris represents more than corporate rebranding—it signals fundamental shifts in how the satellite imagery industry creates and delivers value. For imagery users, this evolution presents both challenges and opportunities.

Organisations should evaluate their satellite imagery strategies considering several factors:

Vendor Relationships: Direct relationships with providers like Vantor offer certain advantages but create dependency risks. Platform-based approaches provide flexibility at potentially higher costs.

Technical Requirements: Determine whether your applications require raw imagery for custom processing or if pre-processed intelligence products meet your needs.

Budget Predictability: Private equity ownership often drives pricing optimisation. Consider locking in long-term agreements or maintaining alternative supply options.

Geographic Coverage: Ensure your chosen approach provides adequate coverage for all operational areas, particularly for Australian and Asia-Pacific regions where certain satellites may have limited tasking priorities.

Looking Forward: The Evolution Continues

The satellite imagery industry stands at an inflection point. Traditional providers like Vantor compete with new entrants offering novel approaches—from large constellations of small satellites to specialised sensors for specific applications. Meanwhile, the democratisation of space technology continues driving down launch costs and enabling new business models.

For Australian businesses, this dynamic environment creates unprecedented opportunities to leverage satellite technology for competitive advantage. Whether monitoring mining operations, optimising agricultural productivity, or managing environmental compliance, access to diverse, high-quality satellite data has never been more critical.

The key to success lies not in betting on any single provider or technology but in maintaining flexibility to adapt as the market evolves. Platforms that aggregate multiple data sources, provide consistent processing capabilities, and offer transparent pricing models will become increasingly valuable as the industry continues its transformation.

Frequently Asked Questions About the Maxar Rebrand

What is Maxar’s new name?

Maxar no longer exists as a single company. Maxar Intelligence is now called Vantor, and Maxar Space Systems is now called Lanteris Space Systems. The rebrand was announced in October 2025.

Who owns the WorldView satellites now?

Vantor (formerly Maxar Intelligence) owns and operates the WorldView satellite constellation, including WorldView-1, WorldView-2, WorldView-3, and GeoEye-1. These satellites continue to provide the same high-resolution imagery services.

Why did Maxar change its name to Vantor?

Private equity firm Advent International, which acquired Maxar in 2023, split the company to allow each business unit to focus on its core competencies. Vantor focuses exclusively on Earth observation and satellite imagery, while Lanteris handles spacecraft manufacturing.

Is Vantor the same as DigitalGlobe?

Vantor is the successor to both DigitalGlobe and Maxar Intelligence. The company inherited DigitalGlobe’s satellite constellation and imagery archives when DigitalGlobe merged into Maxar in 2017, and now continues that legacy under the Vantor brand.

Will my Maxar imagery contracts transfer to Vantor?

Yes, existing Maxar Intelligence contracts and services continue under Vantor. However, renewal terms and pricing may change as the company establishes its new market position.

What’s the difference between Vantor and Lanteris?

Vantor provides satellite imagery and geospatial intelligence services, operating Earth observation satellites. Lanteris Space Systems manufactures spacecraft, satellite components, and space infrastructure for defense and commercial customers.

Ready to explore your satellite imagery options? Geopera provides seamless access to WorldView imagery from Vantor alongside 20+ other satellite constellations through our unified Pera Portal platform. Our processing pipeline ensures consistent, analysis-ready data delivery regardless of source, giving you the flexibility to choose the best imagery for each application while maintaining operational continuity.

Explore available imagery through our Pera Portal → or contact our team to discuss your specific requirements.